The a3 program is accounting software that can be customized to each company to streamline its operations. This software helps to expedite financial processes. It tracks sales, purchases, and transactions with a simple and user-friendly interface.

Accounting is a crucial part of any business; therefore, every company needs an accountant or simple accounting software to manage its business effectively. The a3 program is easy to use for keeping track of all information, and it also helps businesses successfully meet their tax obligations.

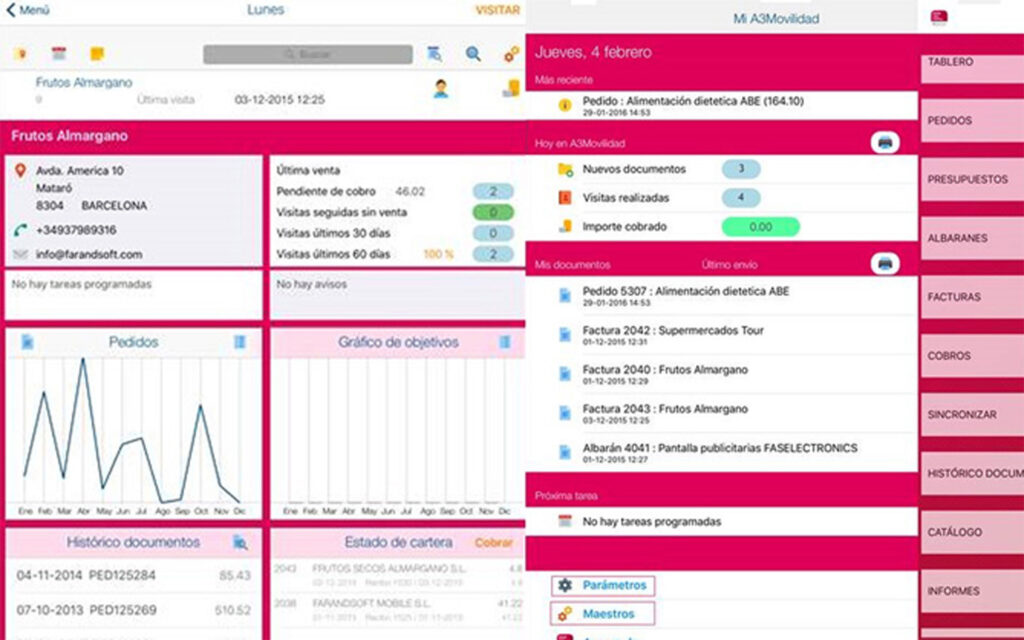

Furthermore, the a3 program allows us to track business success. It enables users to store all the information that provides a clear picture of the company's financial health. The software can easily manage accounting and allows for monitoring costs and revenues to maximize profit margins. With this tool, accounting tasks can be performed quickly and easily, making it ideal for small and medium-sized businesses, as managers can effectively manage and monitor the business.

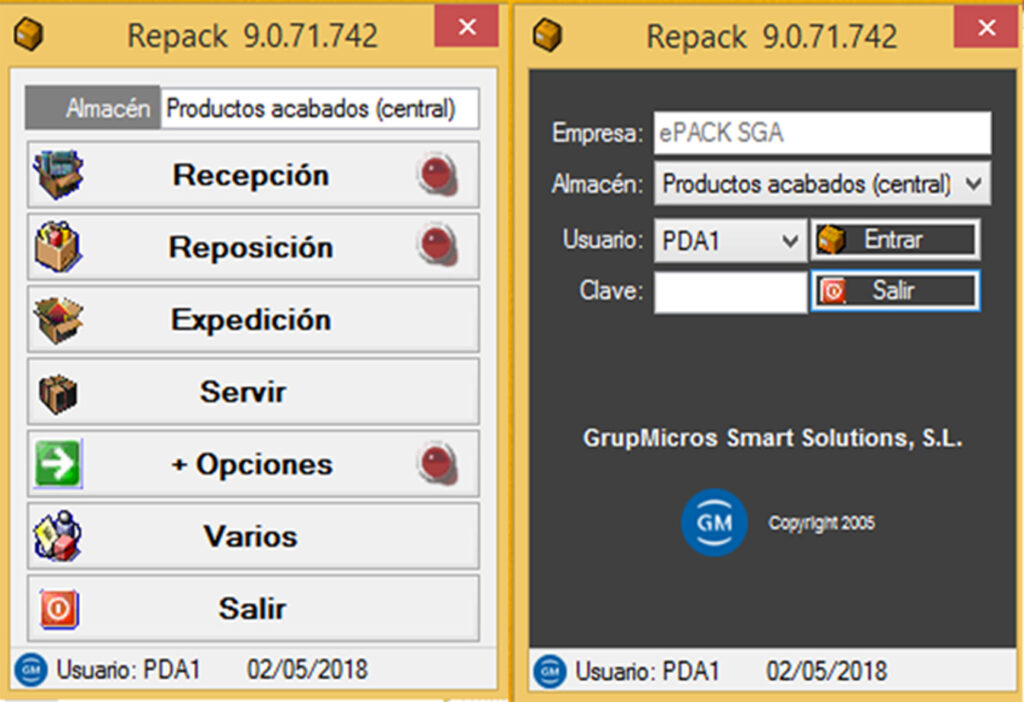

The a3 program allows you to perform accounting tasks quickly, saving time and money, and enabling efficient and simple information and financial management. For example, it handles all collections and payments, bank reconciliation, fixed asset management, returns, and more. It also generates reports that show the company's overall financial status, providing audit trail reports. Having a tool like a3 provides information on the company's overall financial performance, manages all financial aspects of the business, and maintains a record of business transactions. It manages the general ledger, accounts receivable, and accounts payable. Furthermore, it allows you to track cash flow, income, and expenses.

One of the biggest benefits of the a3 program is the high degree of accuracy and speed in data analysis, as well as providing real-time information, which helps to optimize all business transactions.

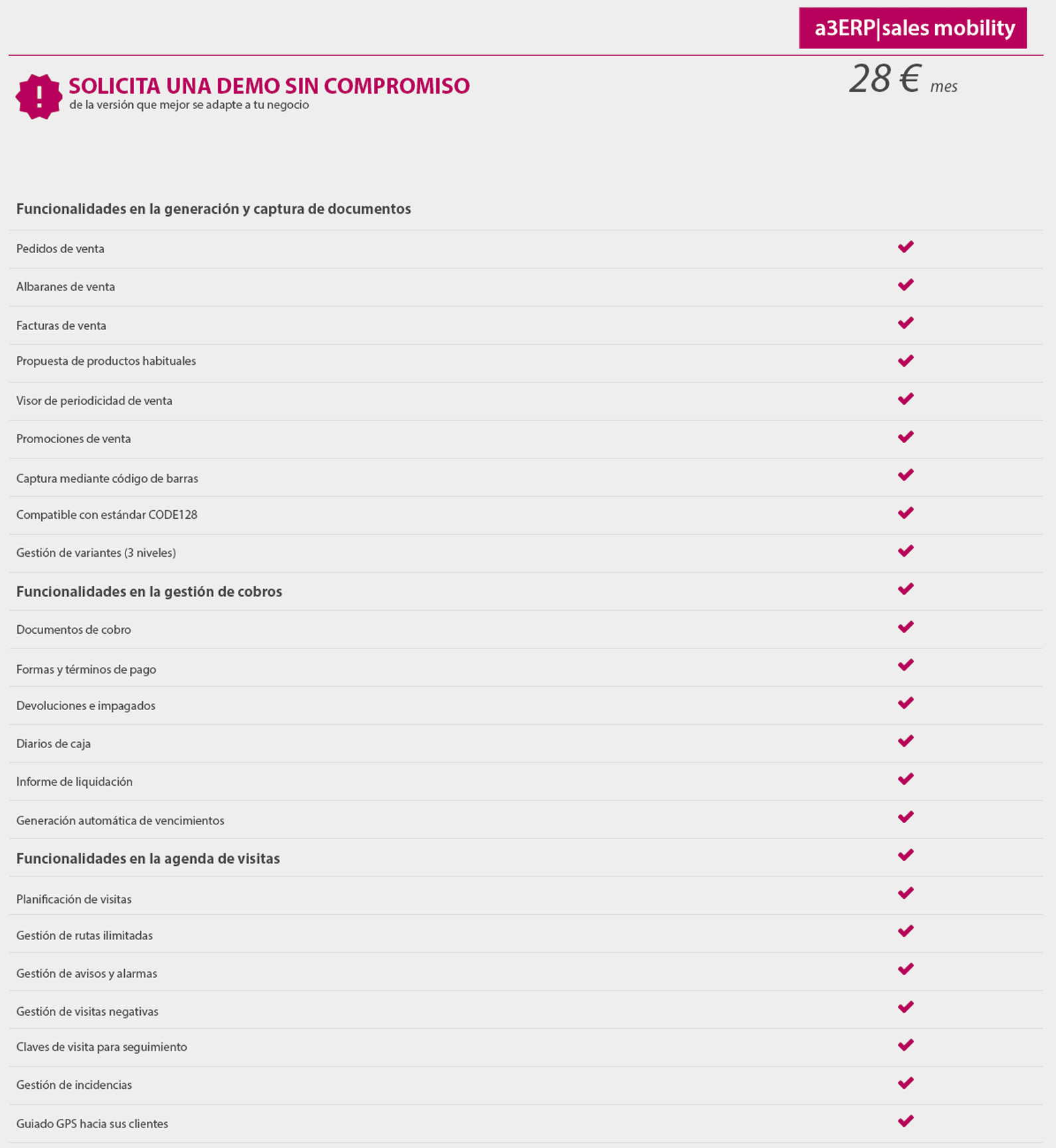

The a3 software adapts to the needs and size of businesses, improving the analytics of all information, risk management, and treasury operations. Furthermore, it generates the main mandatory tax forms, such as VAT, personal income tax, IGIC (Canary Islands General Indirect Tax), and excise taxes, for electronic filing.

Don't hesitate to contact us for complete information about the a3 program, to have all your questions answered, and to receive a plan tailored to your needs and budget. Our priority is meeting your needs, so please don't hesitate to contact us for the ideal solution for your business and to help you grow.