HOW DOES A3NÓMINA CLOUD WORK?

a3ERP cloud payroll It allows you to manage payroll and other personnel administration functions easily, flexibly and securely, taking advantage of the enormous possibilities offered by cloud computing and paying only for the usage made.

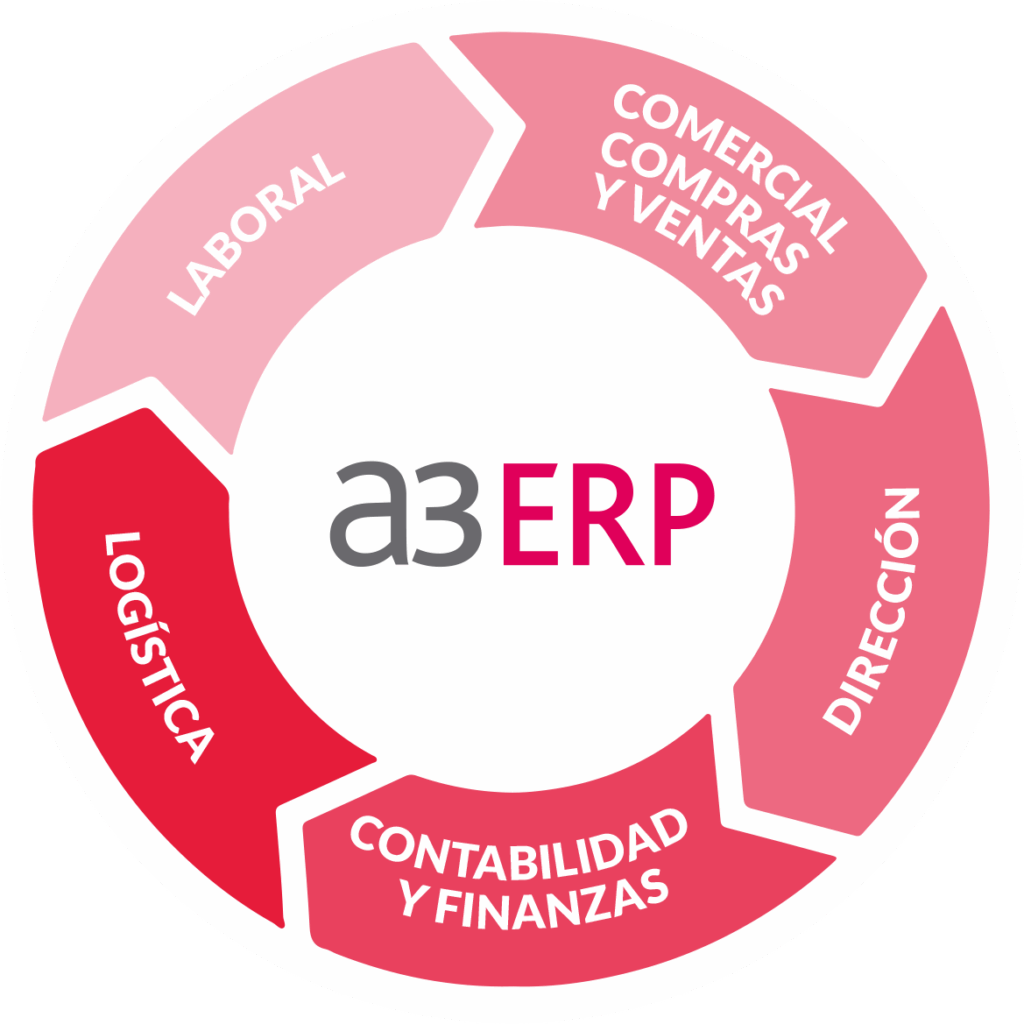

The solution integrates with a3ERP Employee portal, which allows you to decentralize the management of the HR Department, reduce administrative tasks and improve internal communication within your organization.

A3nómina cloud is the perfect solution for those who want to improve their HR process management. This software is ideal for any company, regardless of its size or industry. As cloud-based software, a3nómina cloud requires no maintenance and no complicated installation process.

With a3nómina cloud, companies can adapt to the demands of the current work style, as those who need it can access updated information in real time and from any device, making it ideal for companies with remote workers, employees who are constantly on the move, or businesses with offices in different locations.

Having access to detailed and up-to-date information from the company facilitates effective decision-making, as well as allowing for the control and analysis of company processes, highlighting weaknesses and reinforcing their implementation.

Small and medium-sized enterprises achieve better work distribution and planning thanks to the use of A3nómina for employment history records, advanced searches and personnel management.

A3nómina saves you time and money, and reduces errors by automating payroll calculations, including new hires and terminations, social security contributions, income tax withholding, employment history, and absences. It also offers a secure cloud environment with a backup of all your data. Furthermore, you can stay up-to-date with all your documentation thanks to automatic legal updates to salary scales, collective bargaining agreements, and more.

The software also includes legal information services that provide information on regulations and details how these may affect the company, with a database of more than 1400 collective agreements and updated information on salary tables and agreements.

With a3nómina, payroll calculations, including new hires and terminations, social security contributions, and income tax (IRPF), are automated. This allows for the effective management of employee history, benefiting both employees and improving company efficiency. It also generates forms 111 and 190 for income tax (IRPF) submission to the tax authorities. This comprehensive software solves numerous problems and simplifies the work of the entire team.

The a3payroll system also facilitates internal communication through employee portal access, where payslips, notices, and other information can be downloaded. Each employee will have full access to all their data via their mobile device at any time, any day of the year, ensuring everyone has the same information and preventing misunderstandings.

Don't hesitate to contact us to learn all about a3payroll and to discuss in detail how it can be adapted to your company's needs.