Accounting and payroll software is ideal for small and medium-sized businesses. It's essential to have a tool that streamlines payroll processing, eliminates errors, and provides up-to-date information.

Having payroll and accounting functions integrated into a single program is always the best option. This is especially important for small business owners who need to perform various tasks, prepare reports, and pay taxes. Accounting and payroll software provides a service that can save a considerable amount of time for an already overworked business owner.

There are three ways accounting and payroll software contributes to a company's productivity. First, it influences the growth and development of the entire organization. Second, it increases employee productivity, which further improves the company's overall productivity. And finally, of course, it simplifies human resources procedures, which automatically streamlines the workflows of other departments.

Manual payroll calculations often involve complex salary and tax calculations, which can take up at least 10 hours each month. With accounting and payroll software, HR staff can save this time efficiently and use those hours effectively in other areas of work. In addition to saving time, it's also cost-effective.

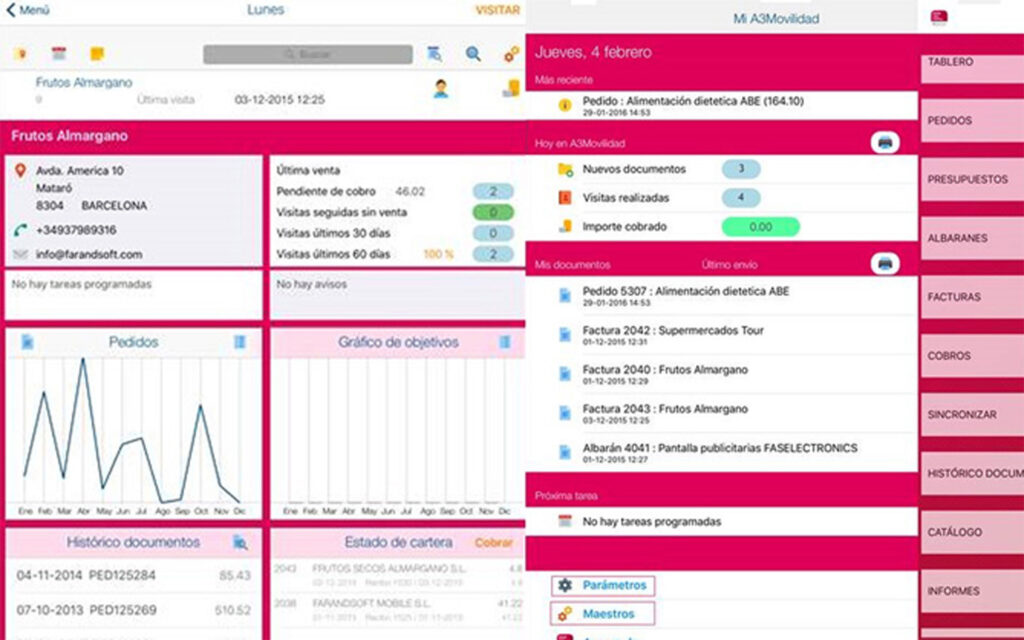

Furthermore, data management is simplified by keeping all records organized and up-to-date, preventing duplicate entries in the system. Accounting and payroll software allows real-time access to the company's database. From salary information to accounts, the necessary data for generating reports can be generated in record time. This allows you to maintain all information on a single platform, control access, and ensure the privacy and confidentiality of all organizational data.

On the other hand, accounting and payroll programs also have features that facilitate daily business operations, such as reminders that ensure you stay up-to-date with employee payments, project deadlines, or corporate tax filings, allowing you to complete all tasks without facing last-minute hassles.

The most important thing when choosing between accounting and payroll software is to study the options they offer and how they can aid in strategic planning and decision-making within the organization. These programs will provide vital information that helps manage a business effectively and finalize decisions, assisting with predictions of future payroll expenses, setting goals, and generally improving long-term organization.