Those in charge of small and medium-sized businesses typically lack the time to dedicate to all the necessary tasks. From day-to-day financial management to payroll and collecting overdue invoices, accounting tasks are time-consuming. Therefore, using accounting and management software is essential to save both time and money.

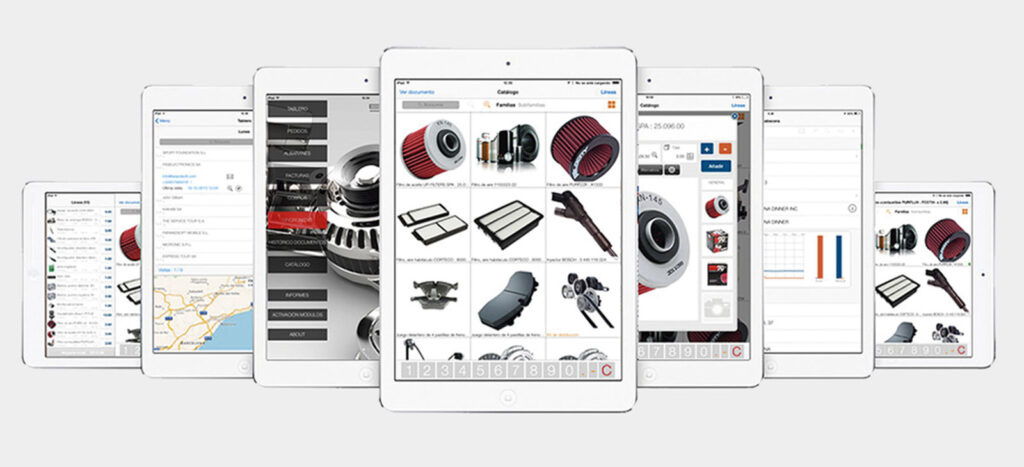

Technology is a wonderful thing, and it's making business finances easier to manage than ever before. Anyone can turn their phone or tablet into a mobile accounting machine by downloading helpful apps that will save them time and money, or they can handle all these tasks from their computer. From sending invoices and managing clients to credit card transactions and complex financial projections, accounting and management software will take care of every business need. Both small and large businesses will find that these programs save valuable time, and when everything is synchronized, accounting can actually be quite enjoyable.

Today, accounting and management software has become a vital necessity for any business. Business owners have begun to realize that managing finances manually will not help them achieve the desired results.

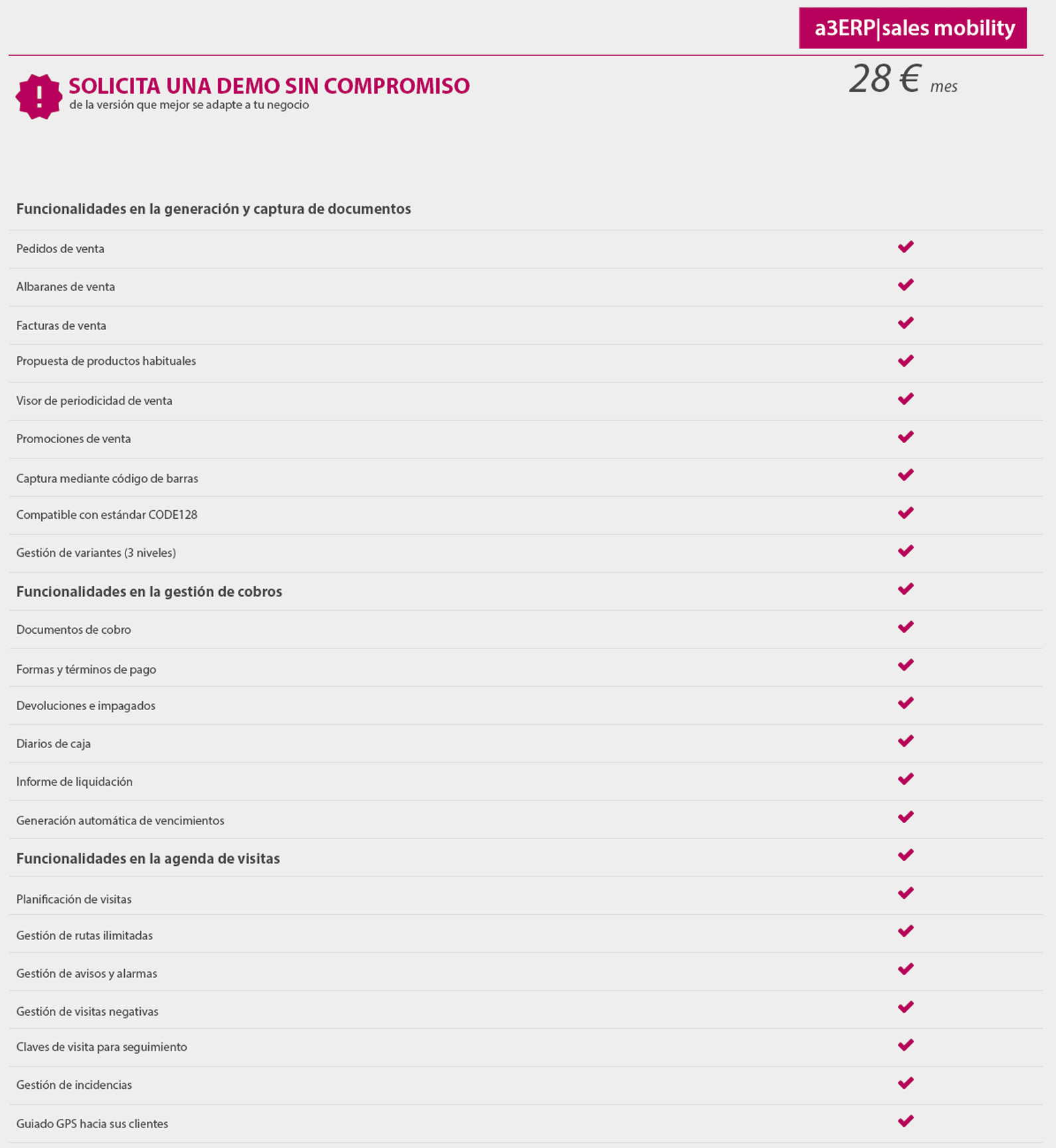

Accounting and business management software has improved dramatically in recent years, and many include all the necessary features for managing a freelancer or a small or medium-sized business. Keeping your accounting up-to-date is essential, so maintaining accurate records will save you a lot of headaches.

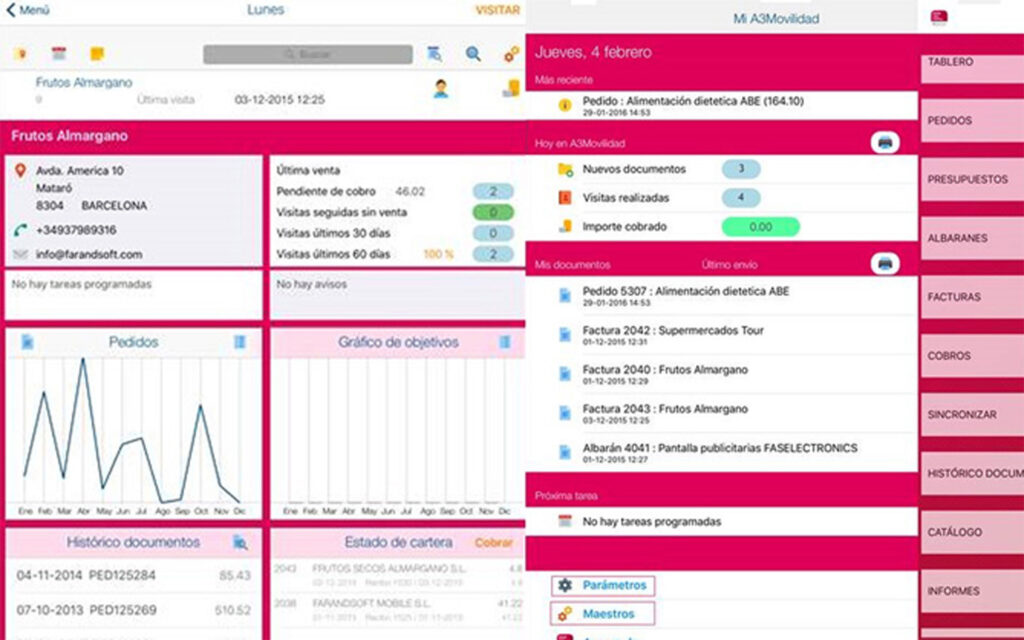

With accounting and management software, you can keep up-to-date financial reports useful for your company, clients, or stakeholders. You can also automatically track expenses and set up budgets.

Furthermore, accounting and management software allows you to establish comprehensive and customized functions tailored to your business needs. For example, accounting and management software enables you to perform accurate and professional invoicing easily and instantly. Another important function of this software is to track income and expenses, along with accounts receivable and accounts payable, providing a complete overview of the company's financial health. This allows you to gather all the necessary data and develop reliable financial statements. Preparing the income statement, balance sheet, and cash flow statement becomes a simple quarterly or annual task. All these features help the company develop illustrative charts and graphs, as well as simplifying tax-related tasks.