Many professionals choose to work independently. However, these workers must add accounting, including tax preparation, to their responsibilities.

Therefore, the best option is to use accounting software for freelancers that can meet the needs of each individual professional. Generally, all freelancers have one thing in common: the need to carefully control their income and, unfortunately, their outgoing funds. They all need some form of cash flow tracking. They also need help tracking and paying taxes. These solutions are readily available in accounting software for freelancers.

The needs of freelancers vary as much as the types of businesses they run. Some want a simple way to track income and expenses. Others need the ability to send invoices and receive and record payments. Some require integrated payroll services, while others are one-person shops. And what about taxes, inventory, and reporting? That's why it's essential to find accounting software for freelancers that suits each professional's specific needs.

When you manage your finances manually, you need to understand concepts like debits and credits and keep track of active tax obligations. But all of these tasks can be handled through accounting software designed for freelancers, which includes forms, records, and transaction logs, all set up for easy use.

The idea is that accounting software for freelancers tracks their income, expenses, and balances in near real-time, all from an easy-to-follow dashboard. Having this detailed picture of their entire financial landscape gives freelancers the agility so critical to their survival.

All accounting software services for freelancers allow you to create invoices, sometimes even recurring ones, and estimates, and send them to clients online. Sometimes, you can also see when a client has viewed an invoice, send them automatic reminders, and calculate late fees. If you handle a high volume of invoicing, you can thoroughly test the invoicing interface of any potential service before committing to one. They are all designed to be used by people who are neither accountants nor tech experts, so they are easy to use. One of the best ways to improve your cash flow is to accept debit and credit cards and direct bank payments so clients can pay instantly and conveniently, although additional processing fees may apply. The more convenient the payment method, the more likely you are to receive payment on time.

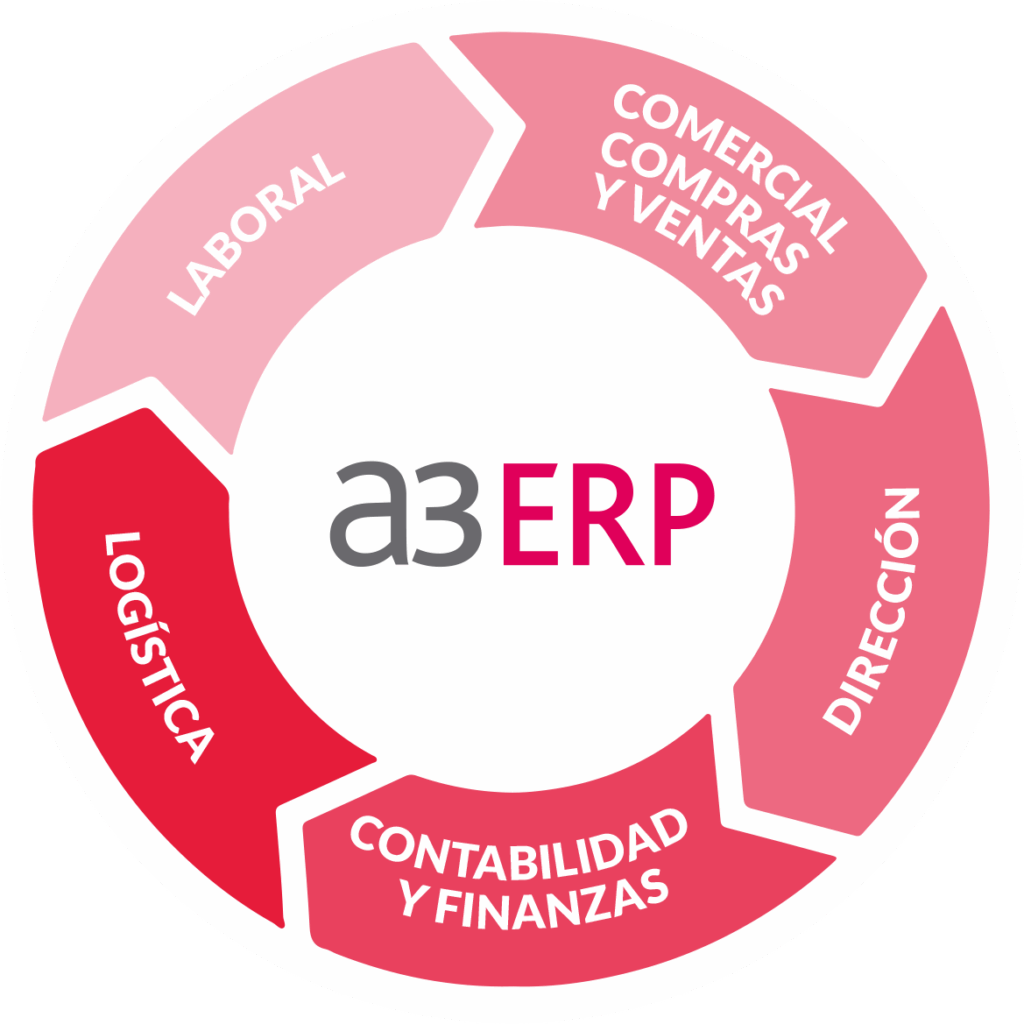

Therefore, we offer accounting software solutions for freelancers, with solutions tailored to the needs of each professional. With these solutions, all financial tasks will be automated and can be carried out easily and efficiently.